[ad_1]

Medium item of Josh Stark and Evan Van Ness, translated from English by Simon Polrot and Jean Zundel

On the eve of EthCC 3, it appeared applicable to translate a retrospective of the occasions of the 12 months 2019 within the Ethereum ecosystem, compiled by an writer of Week in Ethereum. This record categorized by themes, not exhaustive regardless of its magnitude, additionally consists of some explanations of mysterious phrases which have appeared lately, comparable to DeFi, rollups, Eth 1.x… Briefly, a reference to take inventory of what awaits us in 2020.

To start with, Ethereum was a clean web page.

Ethereum is an open blockchain, with out permission, that every one builders can use to create any kind of software, as they see match.

This 12 months, the primary sketches carried on the sheet let glimpse a coherent picture.

You don't should squint to grasp the course that Ethereum is heading. Protocols and functions built on Ethereum started to seek out their viewers, their market, creating communities of hundreds of paying customers.

The empty areas of the desk seem much less and fewer as areas of shadow, of uncertainty. As an alternative, they appear stuffed with the promise of future developments, the alternatives that shall be seized.

2019 was the 12 months that Ethereum gained confidence. The technical roadmap has grow to be clearer as many complicated engineering issues are resolved. And the most important developer neighborhood within the digital asset universe creates apps that you simply pay to make use of.

Final 12 months, it appeared like many of the challenges confronted by the digital asset business have been tackled by the Ethereum neighborhood:

- It's on Ethereum that decentralized change platforms remove the issue of trusted third events and permit customers to change digital items with out ever shedding management of their property and their personal key.

- It's on Ethereum that sensible wallets, the superior wallets, remedy the consumer interface and personal key administration difficulty with out customers having to lose management of their funds.

- It's on Ethereum that " stablecoins Because the Dai sweeps away the issue of the volatility of digital property which prevented their use as a method of fee. On Ethereum, digital money is just not a dream, it's a reality !

As Last year, this text goals to take a step again and present the entire panorama. It is a abstract of an important developments and developments in Ethereum – the issues that can sound like they mattered when wanting again.

For us, the principle developments of 2019 have been as follows.

The economic system constructed round Ethereum continued to develop. DeFi or Open Finance stays Ethereum's predominant enterprise space, however we’ve got additionally seen indicators of development within the discipline of video video games and decentralized autonomous organizations (DAO);

Ethereum is spreading. Main corporations, monetary establishments, manufacturers recognized to most of the people and even celebrities have began utilizing Ethereum.

Ethereum 1.zero has improved. Many initiatives have brought on main efficiency will increase and a course has been taken to make sure the long-term upkeep of the challenge.

Eth2 has made nice progress on the precise implementation, and the foundations are in place for a primary launch section in early 2020.

The second degree layers (Layer 2) have made important progress and new applied sciences have caught the eye of the neighborhood. Rollups and "Zero Data" know-how has made spectacular progress this 12 months, as state channels have continued to enhance.

1. Ethereum's economic system is rising

On this 12 months's evaluate, we wish to examine the adoption of Ethereum in opposition to the remainder of the business.

An necessary measurement issue is just whether or not customers are keen to pay to make use of cryptocurrency or the corresponding decentralized software. At any time when somebody makes use of Bitcoin or Ethereum, they pay charges collected by minors. Listed here are the full charges paid in 2019: Supply: Coinmetrics

This graph reveals the 16 most necessary blockchains, categorized by quantity of charges paid (after all, it doesn’t embrace blockchains that don’t impose the fee of charges to finish a transaction). All supply knowledge can be found here.

The conclusion is obvious right here: there are solely two blockchains utilized in a major manner, particularly Bitcoin and Ethereum. And as we are going to see later, many particular Ethereum functions have extra paid customers than most blockchains with billions of dollars in capitalization.

💰 The 12 months of decentralized finance (bis)

In 2019, DeFi remained probably the most lively and important ecosystem within the Ethereum economic system.

DeFi's imaginative and prescient is easy: another world monetary system. The Web has made data cheap and simply accessible, and Satoshi has made this data useful. In truth, everybody on earth ought to be capable of entry a monetary system (funds, financial savings, loans, investments) over the web.

Despite the fact that this technique could be very in its infancy, it already exists immediately. In the event you dwell in a rustic with a poor monetary system or hyperinflation, DeFi is doubtlessly already a better alternative to local banks and financial institutions…

DeFi has created digital property that retain their worth (" stablecoins "), An innovation essential for any lifelike use of fee methodology. DeFI has enabled hundreds of customers to earn curiosity by lending their ETHs or stablecoins to debtors. DeFI has made it simple to create complicated digital property, execute buying and selling methods and routinely improve your wealth.

All of that is accessible immediately by a monetary system that by no means closes, is totally auditable and clear, and the place your account can’t be closed if you work in the wrong industry or support non-conforming political visions.

This 12 months too, one among Ethereum’s much less nicely understood virtues grew to become a lot clearer: the functions created on Ethereum are interoperable and composable. If you issue a new asset on Ethereum, it can be easily "plugged" into a protocol that will facilitate exchanges. As David Hoffenman described it nicely, Ethereum is made up of " silver legos that make it doable to create extra complicated programs. This enables decentralized finance merchandise to develop sooner and higher serve its customers, instantly utilizing the whole infrastructure that has already been deployed.

Even when DeFi continues to be very stammering and risky, it already has, as a whole monetary system, instruments to handle these dangers. The rates of interest paid to customers who lend their ETH or DAI in DeFi instruments have been comparatively excessive, particularly since these platforms create excessive dangers.

Insurance products like Nexus Mutual have been additionally created to present customers a chance to hedge the danger of utilizing leading edge instruments from a brand new business. Nexus Mutual was deployed in July and customers have already paid greater than $ 11,000 in premiums in 5 months of existence. That is greater than all the transaction charges paid on the Grin blockchain throughout the identical interval ($ 7,600).

📈 What was the expansion of DeFi in 2019?

The best metric to make use of to measure DeFi’s development is the full worth of “locked” property in Ethereum’s DeFi ecosystem. In different phrases, how a lot cash is saved in contracts that function infrastructure for this monetary system?

In 2018, this worth greater than tripled, from ~ $ 70 million to $ 300 million.

In 2019, it greater than doubled to 667 million on December 31, 2019: Supply: Concourse Open, DeFi Pulse

We are able to additionally see the expansion of the DeFi ecosystem by way of not solely the full worth blocked, but additionally the variety of accounts that use them and the variety of interactions with the appliance.

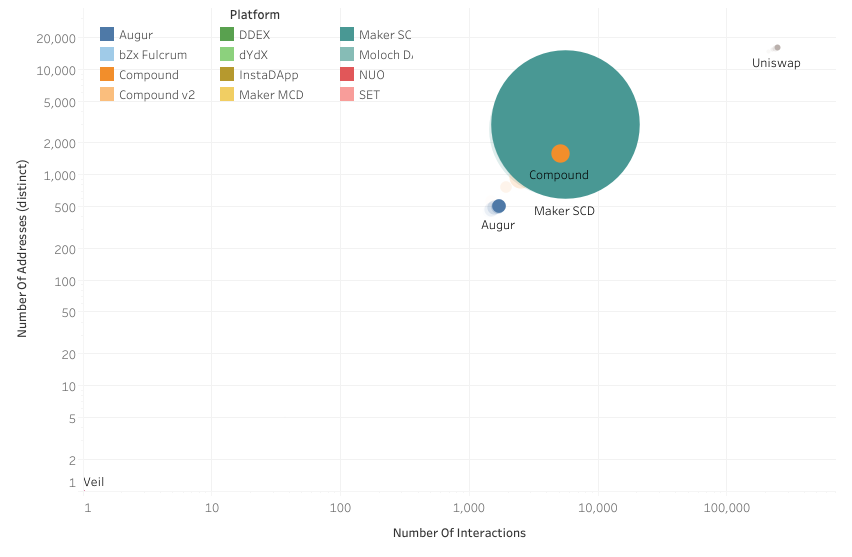

At the beginning of 2019, MakerDAO was the one DeFi protocol with important funds, a complete of 1.86 million ETH (valued on the time at $ 260.four million). Within the graph beneath, the scale of the circle corresponds to the quantity of ETH blocked within the protocol: Supply: Alethio (01–01–2019)

However, by the top of 2019, the sector had diversified: Supply: Alethio (12–15–2019)

Compound has seen its TVL develop (complete worth locked, complete worth blocked) by 1000%, from 35,000 to 350,000 ETH, because the variety of its customers elevated. MakerDAO is captured in full transition between the unique model with “single collateral” (inexperienced circle) and that of the “multi-collateral” DAI (yellow circle). Each kinds of DAI have a mixed TVL of two.15 million ETH, a rise of 16%.

🌐 Decentralized exchanges are rising in range and quantity

Decentralized exchanges (DEX) are a substitute for centralized cryptocurrency exchanges. DEXs help you purchase and promote property on the web with out the necessity for a centralized middleman like Coinbase, Binance or Quadriga.

Some of the attention-grabbing developments of 2019 was the looks ofuniswap.

Uniswap is a brand new kind of decentralized change. In a “regular” DEX, the actors work together with one another: they provide at a sure value, discover a purchaser, and deal straight.

With Uniswap, we deal straight with the Uniswap protocol. He’s the one market maker, which determines the costs and presents to be processed, this 100% On-chain, with out exterior dependence on the chain.

Uniswap is predicated on Ethereum, so anybody can use it by calling their contracts. This enables different DeFi protocols to make use of Uniswap to provoke liquidity for a market, thereby prompting everybody to course of a brand new asset. Uniswap is a very helpful "Silver Lego" that has been built-in into many services.

As Uniswap is predicated on Ethereum, it isn’t censored. You’ll be able to drop a given entrance finish for Uniswap, however the underlying contracts – the product itself – stay accessible to anybody with an web connection.

In 2019, Uniswap went from a median day by day quantity of $ 25Ok to $ 1.5M (a rise of + 6000%) and noticed its accessible liquidity from $ 500Ok to $ 25M (+ 5000%). supply: DeFi Pulse

All through 2019, Uniswap's liquidity suppliers (those that "lock" their property into the protocol, in an effort to get a return on their liquidity-enhancing funding) earned greater than $ 1.2 million in charges.

For comparability, it's greater than the mixed complete of transaction charges paid in 2019 to make use of Ethereum Traditional ($ 587Ok), Litecoin ($ 413Ok) and Ripple ($ 179Ok).

These three blockchains have a mixed capitalization of $ 13 billion. Uniswap is a crew of four individuals who raised a seed spherical, a primary spherical of funding, of $ 1.eight million in mid-2019.

Additionally in 2019:

- Past Uniswap, the DEX on Ethereum had a fantastic 12 months. Whole buying and selling on Ethereum-based DEXs has handed 2.3 billion ;

- Khyber, one of many greatest decentralized exchanges, noticed its volume grow 443% from $ 70 million to $ 380 million;

- 0x ended the 12 months with 254 million in quantity, the variety of trades elevated by 27% focusing on liquidity and R&D ;

- We now have noticed the looks of DEX aggregators like totle, dex.ag and linch.exchange. These are providers that permit customers to seek out one of the best costs on totally different DEX.

🏦 Mortgage providers

Some of the important developments within the Ethereum DeFi ecosystem is the rapid growth in loan services.

These apps permit customers to dam their cryptocurrencies in standalone contracts, the place different customers can borrow them by paying curiosity. In 2019, greater than $ 600 million in loans have been mounted on Ethereum. That is greater than double that all payday loans in washington state ($ 248 million).

For instance, you may at present take the DAI you have and start earning 5.9% annual interest due to the Compound mortgage protocol. In 2019, Compound noticed its TVL develop from $ 20 million to $ 91 million.

Or you may block some of your ETH in the MakerDAO protocol, as collateral to borrow DAI (which you’ll then lend on Compound, if you want).

In 2019, customers paid 5.5 million in fees to the MakerDAO protocol, a complete exceeding the sum of all transaction charges paid on all blockchains aside from Bitcoin and Ethereum.

💵 Stablecoins

The stablecoins embody the unique imaginative and prescient of cryptocurrency as "peer-to-peer digital money", a helpful method to make quick and cheap funds over the web. These are digital dollars that can be utilized to make funds, obtain wages, and that don't lose worth with out warning in unstable cryptocurrency markets.

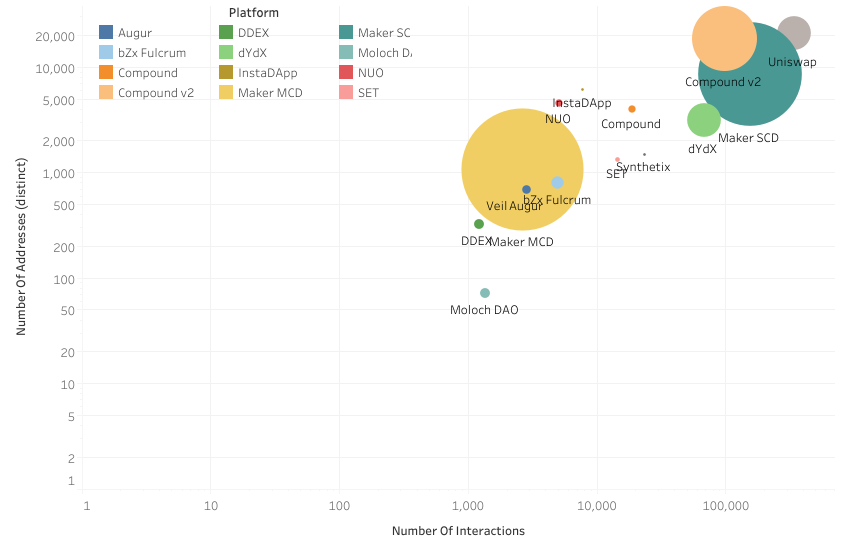

Nearly all stablecoins are primarily based on Ethereum. This 12 months Ethereum has gained additional dominance as Tether, the oldest and most necessary stablecoin, has moved the majority of its show to Ethereum from the Omni protocol (primarily based on Bitcoin). Tether on Omni (darkish inexperienced) and Tether on Ethereum (gentle inexperienced) – Supply: Coinmetrics

In 2019, Tether issued roughly $ 2.three billion on Ethereum, together with greater than $ 1 million on the expense of Omni. That is the most important migration of property from one blockchain to a different in historical past.

MakerDAO, the protocol that helps DAI stablecoin (which has been studied Verbatim in Year in Ethereum 2018), has had a serious replace. Whereas initially DAI may solely use ETH as a single collateral to difficulty new DAIs, in November MakerDAO efficiently launched the " multi-collateral DAI Which authorizes many property on Ethereum within the system.

💥 A Cambrian explosion of property primarily based on Ethereum

One of many main developments in the mean time in DeFi is the growth of merchandise and protocols that facilitate using artificial property. By "artificial property" we merely imply an asset designed to have sure particular traits, usually mimicking the profile of different property.

The programmable side and the interoperability of the property on Ethereum make this strategy pure. Ethereum standalone contracts permit builders to create property that observe the worth of different cryptocurrencies, routinely implement particular buying and selling methods, or create customized derivatives.

Set protocol launched TokenSet in April, a collection of merchandise that permits anybody to purchase an ERC-20 which then implements their very own buying and selling technique. For instance, you should purchase $ 1,000 from an “ETH 20 Day MA Crossover” set, which switches between ETH and USDC stablecoin in line with a selected market indicator. The objective is that, when ETH will increase, this TokenSet is especially in ETH, and when ETH decreases, it switches to a stablecoin to keep away from losses.

Universal Market Access (UMA) has launched a service that permits everybody to create artificial tokens that observe the value of real-world property like shares, or the truth is every little thing why you’ve a steady supply of costs. On the hackathon of ETHBoston, hackers used UMA to create an artificial asset that tracks the deviations of the DAI from the greenback, which ends up in an enormous revenue if the hyperlink between the 2 breaks. AT ETHWaterloo, the UMA crew created a synthetic asset that tracked the number of human excrement spotted in San Francisco, which they instantly integrated into a fork of Uniswap so we will course of it on tesnet.

Synthetix launched its “synths” merchandise, that are ERC-20s that observe the worth of the principle currencies, commodities or indexes. It should be noted that Synthetix started by trying to implement their protocol on EOS earlier than deciding it was an error, and have efficiently restarted on Ethereum.

In 2019, customers paid roughly $ three.5 million in charges to make use of Synthetix, which is bigger than the sum of all transaction charges paid on all blockchains aside from Bitcoin and Ethereum.

Additionally in 2019:

- Efforts to make Bitcoin usable on Ethereum have gained momentum. Kyber, Bitgo and Republic launched WBTC, an ERC-20 backed by actual Bitcoin, saved with trusted companions. In August Preserve & Summa introduced their plans to " trustless BTC "(TBTC) which doesn’t require any central middleman to carry the BTC. The launch is scheduled for 2020.

- RealT a tokenized authorized possession of a number of Detroit houses, beginning with 9932 Marlowe. The house owners of those tokens have entry to liquidity through Uniswap, the place they’ll at all times discover a purchaser to purchase their share of the home.

- Compound – already talked about above within the part on loans – launched CDAI, a token that generates curiosity. Merchandise like cDAI blur the excellence between a "mortgage service we use" and "an asset we purchase".

- Many artificial property depend upon an oracle for data. The oracles trustless don’t have any resolution and stay one of the "hard" problems within the cryptocurrency area.

👾 The gaming sector is rising at Ethereum

In 2019, the sport ecosystem in Ethereum confirmed early indicators of development.

Some of the telling examples is Gods Unchained : a collectible card sport, just like Blizzard's Heartstone. The distinction is that Gods Unchained playing cards are property on Ethereum: they are often purchased, offered, traded through DEX, and even at some point used as collateral.

In 2018, they offered $ four million value of playing cards out there, and this 12 months, they’re beginning to "activate" these playing cards to be used within the sport. This resulted in the largest transfer of "non-fungible tokens" (ERC-721) in history. supply: Coinmetrics

GU launched free card trading in November. In a couple of days, greater than $ 220,000 of playing cards have been traded on OpenSea, one of many predominant marketplaces for NFTs.

The opposite notable launch was PoolTogether.

PoolTogether is a lossless lottery system made doable by Ethereum. The precept is easy: gamers deposit DAI in a program operating on Ethereum. This reserve of cash earns curiosity over time, by routinely lending it out Compound. Then, on the finish of the interval, a participant earns curiosity (on the time of writing this text: $ 688 every week). If you don’t win, you haven’t misplaced the value of your "ticket" since you may merely withdraw your cash.

PoolTogether was launched in June, and inside 6 months of its customers incomes a complete of $ three,594. Over the identical interval, Tezos validators earned transaction charges totaling $ three,745.

PoolTogether is particularly notable as an indicator of a elementary pattern: monetary functions that appear like video games, and video games that appear like finance. There has at all times been an area the place these two worlds meet – WoW, EVE On-line, casinos, the inventory market – however Ethereum abolishes the excellence. We are able to anticipate to see many new arrivals on this new category in 2020.

Additionally in 2019:

👹 DAO – Decentralized Autonomous Organizations

From the beginnings of Ethereum, individuals have dreamed of making CAD, Decentralized Autonomous Organizations or decentralized autonomous organizations.

The thought is easy: Ethereum permits you to write uncensored code that runs on a decentralized platform. We are able to create a program that holds funds and defines a governance course of that determines handle these funds, for instance, by a voting course of.

Since fork of TheDAO in 2016, the thought was haunted by this controversial legacy. However in 2019, new initiatives have rekindled curiosity in CAD.

Whereas 2019 was on no account "the 12 months of CAD", we not less than noticed a couple of "Moloch months". MolochDAO, launched in February 2019, goals to finance public items within the Ethereum eco-system. From cash donated by a number of sources (such because the Ethereum Basis, Vitalik, Joe Lubin and Consensys), MolochDAO members vote on the initiatives to be funded.

This straightforward mannequin ended up changing into the CAD challenge that captured probably the most consideration from the Ethereum neighborhood, with different initiatives taking on like MetaCartel and MarketingDAO. Ross Campbell launched a project on "LAO" or authorized CAD which interoperate with conventional authorized programs, influenced by the MolochDAO framework.

In one other instance of the character of Ethereum lending itself to composition, Saint Fame, the CAD of a "decentralized style home", launched its first product in December.

Saint Fame launches tokens on Uniswap, which might then be redeemed for a selected product: a designer t-shirt. The free change of tokens on Uniswap permits the value of the t-shirt to go up and down in response to demand. DAO members vote on how the funds are used to create new fashions, which might then be offered by the identical mechanism.

Saint Fame is predicated on Aragon, a framework and a toolbox for CAD. Aragon itself has seen indicators anticipating adoption, and by the top of 2019 over 900 DAOs have been created utilizing this framework.

2. Ethereum breaks into the actual world

In September, the NBA participant Spencer dinwinddie has introduced plans to tokenize their contract. He needs to promote 90 tokens primarily based on Ethereum, which can give their holders a part of the worth of his future contract, plus curiosity.

The NBA initially opposed it, saying it broke Spencer's contract with the league. However within the months that adopted, the challenge was revived, and was to be launched in early 2020.

Probably the most extraordinary factor on this story is that in 2019, it didn’t appear extraordinary. In the event you had imagined in 2015 that within the subsequent few years an NBA participant would use Ethereum for a monetary innovation, nobody would have taken you severely.

However it occurred this 12 months, with many small initiatives in the actual world:

In the meantime, within the company world, the road has began to vanish between the "company blockchain" and the "mainnet Ethereum".

Firms have understood that a personal or consortium chain is just not that totally different from a centralized database. They started to take an curiosity within the Ethereum mainnet, which presents an open platform backed by billions of dollars in financial safety.

One of many predominant attorneys within the mainnet for corporations was EY, who continues his work on "Nightfall". Dusk is a challenge that goals to allow corporations to make use of the Ethereum mainnet, making certain that transactions are personal and may scale, two of the principle considerations limiting the adoption of Ethereum in enterprise immediately . In December, EY launched Nightfall v3, lowering the transaction value to some cents as a substitute of dollars.

In the meantime, Microsoft has continued to take a position closely within the Ethereum ecosystem. In Could, Microsoft launched the Azure Blockchain Development Kit, particularly to help growth beneath Ethereum. Visible Studio, Microsoft's customary growth atmosphere, now helps Ethereum by a fully integrated extension to Truffle. In June, they introduced VeriSol, a proper verification device for Ethereum.

In October, Microsoft joined the Enterprise Ethereum Alliance to work on an incentive system tokenized to be used by company consortia. And November noticed the launch of Azure Blockchain Tokens, a service that permits corporations to difficulty their very own tokens on Ethereum.

Many of those developments – whether or not in most of the people or within the office – could seem minor. However, collectively, they type a transparent image: as common curiosity in cryptocurrencies has slowed, Ethereum continues to broaden outdoors the cryptocurrency business, and there are indicators of adoption past the bottom neighborhood.

Additionally in 2019:

three. Efficiency and sturdiness of Ethereum 1.zero

Every of the functions we mentioned above – a whole lot of hundreds of thousands of dollars in DeFi protocols to enterprise functions – runs on the present protocol and present Ethereum clients.

This 12 months, "Ethereum 1.zero" and the purchasers who help it have obtained among the most important updates because the launch of Homestead in 2016. These adjustments have addressed state development, consumer synchronization instances, disk I / O, transaction throughput, and transmission. There have been extra PIEs deployed in 2019 than in another 12 months.

🏆 Geth

Geth, Ethereum’s major buyer, has obtained main updates this 12 months. In July, Geth's team released v1.9.0, which included efficiency enhancements and lots of options. This 12 months, the Geth crew has lowered the time Quick Sync, quick synchronization, ~ 4 hours for a full knot, and applied a 10x reduction in disk I / O.

The Geth crew needs to be counseled for repeatedly bettering probably the most broadly used consumer software program to run Ethereum. This work might not at all times get the eye it deserves, not like a brand new breakthrough from an software or primary analysis, however it’s this work that makes Ethereum doable.

Have you ever thanked your Geth maintainers immediately?

⚙️ ETH 1.X

At Devcon4 in November 2018, a gaggle of core builders started to speak informally about enhance Ethereum 1.zero efficiency by way of state dimension, synchronization time, and disk I / O. Though the long-term objective is migration to Eth2, Ethereum should stay sustainable till then.

Within the months that adopted Devcon, this initiative grew to become generally known as “ETH 1.X”. Whereas many have taken it for a chance to provide you with a complete vary of concepts on change the EVM, the first objective has been sustainability by ideas like state rental, stateless clients or adjustment of gasoline prices.

The outcomes have been main enhancements to Ethereum 1.zero throughout the board.

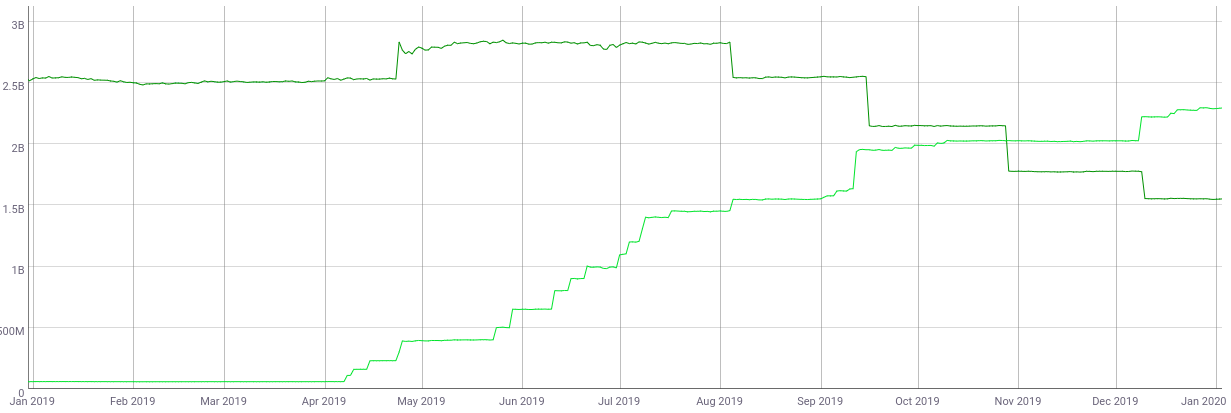

The utmost throughput has been elevated from ~ 25 to ~ 38 transactions per second. This was made doable by growing the block restrict to 10 M gasoline, whereas the block time was lowered to 13 seconds after the Istanbul arduous fork. TheEIP-2028 additionally contributed to this enchancment by lowering the gasoline value by one byte in a transaction entry from 68 to 18 gases.

The Parity client optimizations suggested by Alexey Akhunov made it doable to extend the block restrict with out simultaneous improve in uncle rate. Because of this, this fee has collapsed. supply: Etherscan

The brand new ETH difficulty fell in 2019. The Constantinople hard fork reduced it from 3 to 2 ETH. As well as, the decline within the fee of uncles has additionally lowered emissions, because the manufacturing of an uncle earns a partial reward.

That's why Bitcoin and Ethereum emission charges are actually comparable, that of Ethereum nonetheless to fall when the community shall be totally in proof of stake: Supply: Eric Conner

With the intention to remedy the issue of sustainability in the long run, 2019 noticed main advances within the seek for a mannequin " stateless For Eth1. Different approaches thought-about initially of the 12 months, comparable to state leasing, have seen their precedence lower.

The objective of the stateless mannequin is to cut back the quantity of state knowledge that have to be saved by every node. Utilizing easy strategies like Merkle bushes, we will present a " block witness » prouvant qu’une donnée spécifique se trouve dans un bloc spécifique sans demander au consumer de conserver toutes les données du bloc. De nombreux nœuds conserveront un état complet, mais d’autres pourront stocker moins de données.

Un projet associé est Beam Sync, qui utilise des witness de bloc pour réduire la synchronisation à quelques minutes, en opérant une synchronisation « complète » en tâche de fond. D’autres varieties de shoppers « semi-sans état » arriveront au fur et à mesure des progrès en la matière.

four. Eth2 est (presque) là.

La imaginative and prescient d’Ethereum a toujours été une blockchain scalable, succesful de passer à l’échelle, en preuve d’enjeu. Il a été très clair depuis les premiers jours des cryptomonnaies qu’en dépit du bond technologique, la preuve de travail est profondément défectueuse.

similar les estimations optimistes de la consommation énergétique de Bitcoin la placent à un niveau comparable à celle de pays comme le Portugal ou la Nouvelle Zélande. La migration vers la preuve d’enjeu va éliminer cette consommation inutile d’énergie et permettre à Ethereum de croître pendant des décennies sans accroître radicalement la consommation mondiale en énergie.

Bien que les grandes lignes de la migration d’Ethereum vers la preuve d’enjeu aient été claires même en 2015, la mise au level des détails a constitué un travail prudent et difficile.

La migration d’Ethereum vers la preuve d’enjeu – connue sous le nom de Eth2 – a pris plus longtemps que prévu. Après de nombreuses années de R&D, 2018 a vu le projet passer d’un sujet de recherche à un problem d’ingénierie. En 2019, plusieurs équipes indépendantes ont travaillé à écrire le logiciel nécessaire au lancement de la première section d’Eth2. Il y a maintenant peu de doute que Eth2 entrera en manufacturing en 2020.

Comme tout bon projet open supply, Eth2 est édifié au vu et au su de tout le monde. Ce processus peut sembler désordonné à ceux qui ne sont pas familiers avec le modèle du « bazar » du développement logiciel en open supply, ou qui sont plus familiers avec les cryptomonnaies contrôlées par une équipe en cost d’un consumer distinctive.

Eth2 est un vaste projet qui se déroulera en plusieurs phases sur des années. La première section, Part zero, doit être lancée au deuxième trimestre de 2020. Cela implique de lancer la Beacon Chain (la chaîne phare), qui sert de « dorsale » à Eth2. Part 1 introduira ensuite les shards, les chaînes fragments, qui seront sécurisées par la Beacon Chain sous-jacente. En Part 2, le système se révèlera en tant qu’ensemble fonctionnel. Les fragments deviendront utilisables pour les transactions, les contrats autonomes et toutes les fonctionnalités de base familières aux utilisateurs d’Ethereum aujourd’hui.

Au début de l’année, 9 équipes indépendantes ont commencé à travailler sur l’implémentation de la Beacon Chain de la Part zero. À la fin de l’année, Eth2 begin à voir apparaître des testnets matures.

Ils ont commencé cet été comme des testnets privés, par chaque équipe, et en septembre plusieurs shoppers étaient succesful d’interagir sur un testnet partagé. La clef du succès est l’initiative de Joseph Delong, où pendant une semaine les équipes implémentant Eth2 se sont retrouvées isolées à Skeleton Lake, Ontario, afin d’arriver à l’interopérabilité entre leurs shoppers et les requirements réseau établis. En décembre, ce programme a permis la mise en place de testnets publics d’une durée de vie plus longue entre plusieurs équipes. On peut même visualiser ces testnets sur des explorateurs de blocs publics comme Etherscan.

Alors qu’Eth2 apparaissait au grand jour, la communauté des développeurs a été succesful de formuler des retours – et critiques – qui ont mené à des ajustements. En particulier, juste après Devcon, Vitalik a publié plusieurs notes proposant des changements à la Part 1 réduisant la complexité de l’interaction entre les shards, les chaînes fragments.

La dialogue reste lively concernant les meilleures approches pour implémenter Part 1 et Part 2, ainsi que la manière de migrer la blockchain Ethereum existante vers Eth2. Des propositions sont actuellement débattues, comme celle où Eth1 serait le premier fragment d’Eth2, qui prendrait place entre les Phases 1 et 2. Le débat se poursuit également sur la finalisation (au sens PoS) de la chaîne Ethereum actuelle en preuve de travail par la chaîne phare d’Eth2, qui autoriserait une réduction bien plus rapide de l’émission d’ETH.

Pendant ce temps, la disponibilité des données de la Part 1 permettra à des options de couches de niveau 2 comme les rollups and the state channels d’apparaître. Par exemple, le débit potentiel des rollups (qui peuvent déjà assurer 2000 ou 3000 tps sur Eth1) devrait croître d’environ 100x.

Eth2 arrive : préparez vos enjeux pour 2020.

5. Couches de niveau 2 et applied sciences hors chaîne

L’idée derrière toutes les technologies du niveau 2 est que l’on peut effectuer des calculs coûteux off chain, hors chaîne, tout en conservant les garanties de sécurité caractéristiques d’Ethereum. Cette couche de niveau 2 peut traiter des transactions ou des calculs bien plus rapidement que la chaîne principale d’Ethereum, menant ainsi à un réseau globalement plus extensible.

À la fin 2018, Barry Whitehat proposa les ZK rollups. L’idée de base est d’effectuer de nombreuses transactions hors chaîne en les agrégeant. Ce groupe rolled up, agrégé, est ensuite vérifié par des arguments de connaissance succincts à divulgation nulle de connaissance, les zk-SNARK, qui confirment que chaque transaction est correctement signée par les propriétaires, empêchant ainsi toute transaction invalide ou manipulée.

Au début de 2019, cette notion a donné lieu à plusieurs projets allant dans une nouvelle course. En juin, John Adler et Mikerah ont publié leur travail dans « Minimal Viable Merged Consensus », et en parallèle le Plasma Group a publié leurs travaux sur la « Optimistic Virtual Machine » en juillet.

Finalement, la communauté de la recherche s’est accordée sur le terme « Optimistic rollups » pour décrire cette catégorie de strategies, qui partage certaines similarités avec une idée que Vitalik avait à l’origine appelé « shadowchains » dans un article de blog de 2014. Vitalik put résumer ce domaine de recherche dans un article de blog en août.

Les optimistic rollups utilisent une approach analogue à l’agrégation des transactions des ZK rollups, mais utilisent un mécanisme différent pour les « prouver ». Au lieu d’employer des zk-SNARK, les optimistic rollups utilisent un mécanisme cryptoéconomique qui permet au système de supposer de manière « optimiste » qu’il n’y a pas de transaction invalide, tout en continuant d’attraper, de prévenir et de punir (en retranchant des ETH d’un dépôt) ceux qui pourraient essayer.

À Devcon en octobre, le Plasma Group a sorti une démo qui utilisait un Optimistic Rollup pour livrer une model ultra-rapide d’Uniswap appelée Unipig.

ZK Rollup et Optimistic Rollup possèdent chacun des avantages et des inconvénients. Les optimistic rollups sont plus faciles à implémenter à courtroom terme, et restent assez souples pour être utilisés avec diverses functions. Les ZK rollups, en revanche, ont plus de potentiel sur le lengthy terme, mais sont plus spécialisés en raison de leur utilization des ZKP (Zero Data Proofs ou preuves à divulgation nulle de connaissance), et demanderont plus de R&D pour servir un massive panel d’functions.

Pendant ce temps, les State Channels sont entrés dans une section de leur développement moins horny mais non moins importante. Sans qu’apparaisse de problème bloquant pendant leur recherche, plusieurs équipes ont travaillé à l’implémentation d’un framework viable que les functions pourraient utiliser pour supporter ces canaux.

En juillet, les principales équipes travaillant sur les state channels se sont rencontrées à ETHNewYork pour discuter de requirements commun afin d’assurer l’interopérabilité, ce qui a mené à l’annonce d’une spécification unifiée simplement appelée State Channels. Counterfactual et Magmo ont fusionné leurs équipes d’ingénierie, ont remplacé leurs propres marques par celui du projet commun, et ont continué de progresser par la suite.

Plusieurs projets de state channels ont été lancés sur le mainnet cette année. En mars, Connext, une plateforme de micropaiements, ont sorti Dai Card, un système de paiement easy basé dans un navigateur, basé sur les channels. En septembre, Connext a lancé la v2.zero de leur plateforme sur le mainnet, au dessus de la base de code maintenant unifiée des State Channels.

En juillet, Celer a lancé son alpha sur le mainnet. En octobre, l’appli cellular Celerx supportait 60 000 utilisateurs actifs.

Adex, avec une implémentation propre de leur framework de canaux de paiement, a sans bruit construit un réseau de canaux de paiement significatif, réglant plus de 9 millions de transactions en 2 mois pendant l’été.

Starkdex, un projet entre Starkware et Ox, a lancé un PoC en juin. En octobre, ils ont sorti OpenZKP, une implémentation open supply en Rust des ZKP. En octobre, Starkware annonçait leur projet de lancer le premier DEX fondé sur les zk-STARK (Zero-Data Scalable Clear ARguments of Data) en collaboration avec Deversifi, au début 2020.

Qu’est-ce que tout cela signifie ?

Cet article n’est pas exhaustif. Remark cela serait-il doable ? Trop de choses se passent sur Ethereum pour qu’on puisse en conserver la hint, même quand on écrit une chronique hebdomadaire sur le sujet.

Quelques autres sujets dignes d’intérêt :

- The sensible wallets ont gagné du terrain. Ces portefeuilles avancés utilisent des contrats pour implémenter une logique d’accès et de contrôle, ce qui améliore leur utilité. Par exemple, cela autorise l’authentification multi-facteurs, le traitement par lot (batching) des transactions, et de meilleures méthodes de recouvrement en cas de perte des clefs. Trois des plus notables entrants dans cette catégorie sont Money, Dharma and Gnosis Safe ;

- Les principaux portefeuilles Ethereum continuent de croître. Metamask dépasse le million d’installations sur le Chrome retailer, et a lancé une version mobile. Brave, un navigateur et un portefeuille basés sur Ethereum, a passé les 10 millions d’utilisateurs actifs, et a atteint plus de 35 0000 « éditeurs » pour sa plateforme de micropaiements en décembre ;

- Les marchés prédictifs continuent leur development. Augur a doublé ses positions ouvertes, de 1,three à 2,7 hundreds of thousands de dollars, Sight de Gnosis est lancé en alpha, et le protocole Erasure of Numerai tourne sur le mainnet ;

- Ethereum Identify Service (ENS) a lancé son nouveau registrar permanent, a rendu les noms ENS compatibles avec les NFT, et a vu les utilisateurs payer 350 000 $ en frais sur ses deux contrats de registrar. C’est à peu près équivalent à la totalité des frais payés pour utiliser Sprint, Monero, NEO, Bitcoin Money et Bitcoin SV, combinés, en 2019 ;

- La communauté Ethereum a étendu sa capacité à financer des biens publics. MolochDAO a été lancée, Gitcoin Grants a capturé l’consideration de la communauté, et le programme de subventions de la Ethereum Foundation a été refondu en Ecosystem Support ;

- Ethereum.org a été relancé, and la communauté l’a traduit en 20 langues, alors que le site compte plus de 100 contributeurs ;

- Oh, et ETH est de l’argent.

Si l’on ne prête consideration qu’aux nouvelles des medias sur les cryptos, on pourrait penser que 2019 a été une année décevante. Le marché s’embourbait, les lancements de protocoles des nouvelles blockchains décevaient, et les gros titres disparaissaient des journaux. On aurait dit que la crypto était en practice de mourir.

Mais, si vous êtes arrivés jusqu’ici, il devrait être facile de voir pourquoi la communauté Ethereum ne partageait pas ce sentiment.

En 2019, il est clair qu’il y a eu assez d’activité réelle au niveau de la couche applicative pour nous donner confiance dans la course prise par Ethereum. Le travail effectué au niveau protocolaire signifie qu’Eth1 peut être sturdy à moyen terme, et les progrès tangibles et constants sur Eth2 donnent confiance dans la imaginative and prescient d’un Ethereum servant un jour des milliards d’utilisateurs. L’hiver a été impolite, mais Ethereum a continué sa development envers et contre tout.

La crypto est morte ? Vive Ethereum.

Merci à Jinglan Wang, Danny Ryan, Hayden Adams, Alex Xu, Hugh Karp, David Hoffman, James Hancock, Alexey Akhunov, et bien d’autres pour leur contribution à cet article.

Articles similaires

[ad_2]

Source link